PERCEPTIONS OF RISK

Why sustainable finance risks undermining its own efforts

Many ‘green’ investment strategies will not meaningfully contribute to sustainability because they are flawed, researchers warn

- The finance sector's definition of risks threatens to undermine and create sustainability strategies that are wildly off the mark

- Researchers unpack the disconnect between environmental and financial risk

- They identify three ways the financial sector can change to contribute to actual sustainability

A FALSE SENSE OF SECURITY: In recent years, the finance sector – banks, pension funds, insurance companies and investment companies - have ramped up efforts to improve sustainability.

This momentum has led to a range of new frameworks and initiatives, and to significant amounts of capital being directed towards ‘green’ investments.

However, the lopsided way in which these efforts define and address risk threatens to undermining them and creating sustainability strategies that are wildly off the mark.

In a recent paper published in One Earth, centre researchers Beatrice Crona, Victor Galaz and Carl Folke unpack the disconnect between environmental and financial risk.

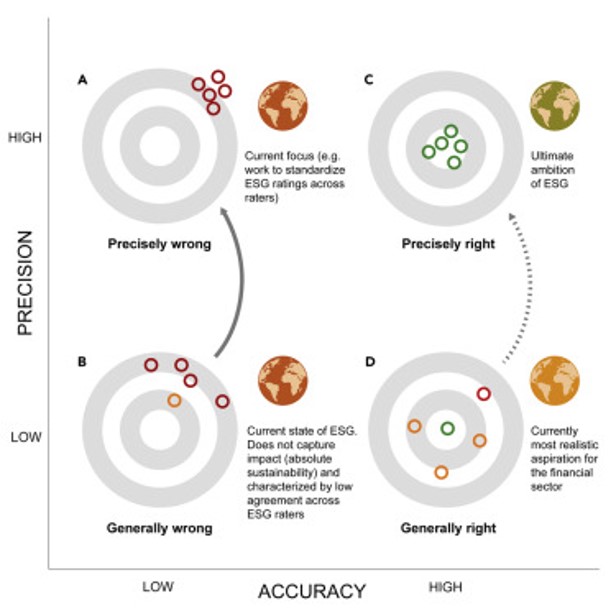

Through analysis of environmental, social, and governance ratings and estimates of global green investments, they demonstrate how this disconnect around risk plays out in practice.

Missing an opportunity

The majority of initiatives and frameworks base their analysis entirely on what is financially material in the short term. While understandable, this no longer suffices in a hyper-connected world grappling with large-scale environmental change.

In fact, investments in economic activities that drive e.g. biodiversity loss, deforestation, land-use change and green-house gas emissions are taking the world across a number of planetary boundaries, and possibly destabilizing important parts of the Earth system, such as the Amazon rainforest, with severe repercussions on global warming.

This, in turn, will create systemic risk – something the financial sector is keen to avoid.

Victor Galaz notes, “Even financial risk frameworks explicitly aimed at incorporating climate systemic risk, such as Aglietta and Espagne, fail to recognize that propagation mechanisms can also be linked to interconnections between Earth system processes.”

The team argue that as long as frameworks in use do not incorporate this aggravation risk, financial actors are missing an opportunity to actively mitigate systemic risk.

“Along with the fact that most current Environmental Social and Governance metrics do not capture actual impacts of company operations, it severely hampers the ability of investors to rapidly move the needle in favor of sustainability.”

Beatrice Crona, lead author

Another elephant in the room

The substantial increase in ‘sustainable’ investments is largely due to the growth and mainstreaming of so-called Environmental Social and Governance (ESG) metrics, used by investors to assess the sustainability of companies.

However, many of the investment strategies listed under the ‘ESG’ banner will not meaningfully contribute to sustainability. Either because they provide merely relative measures or because the metrics used to assess environmental impact of investments are flawed.

Lead author Beatrice Crona, who is also the director of the Global Economics Dynamics and the Biosphere programme, explains:

“Without a clear benchmark against which to judge the actual negative and positive contribution of a company to a particular variable, like CO2 or total area deforested, this type of screening provides a false sense of security in the progress of sustainable investment.”

She continues, “Along with the fact that most current ESG metrics do not capture actual impacts of company operations, it severely hampers the ability of investors to rapidly move the needle in favor of sustainability.”

Three ways to account for risks

The research team identifies three ways the financial sector can change to contribute to actual sustainability:

First, recognise a wider set of Earth system processes (including the climate and hydrological flows in addition to greenhouse gases)

Second, acknowledge that current risk frameworks lack awareness of the risk of aggravating climate and large-scale environmental change.

And third, develop impact accounting systems that account for actual impact (aka externalities), are aligned across different forms of financial investments (both equity and debt) and become a core part of capital allocation decisions.

Crona, B., Folke, C., Galaz, V. 2021. The Anthropocene reality of financial risk. One Earth, Vol. 4, Issue 5, P618-628, https://doi.org/10.1016/j.oneear.2021.04.016